欧博百家乐Positron Aggregator Review (January 2026)

As decentralized finance continues to fragment across chains, protocols, and liquidity venues, traders increasingly rely on aggregation layers to simplify execution and improve pricing. Instead of manually navigating multiple decentralized exchanges, aggregators help surface the best routes, deepest liquidity, and most efficient swaps in one place. Positron positions itself within this layer of the DeFi stack, aiming to streamline how users discover and access on-chain liquidity across ecosystems. By focusing on aggregation rather than acting as a standalone exchange, Positron seeks to reduce friction for users who want faster execution, better rates, and a more unified trading experience in an otherwise fragmented DeFi landscape. Read this Positron Aggregator Review to know more about the platform.

What is Positron Aggregator?

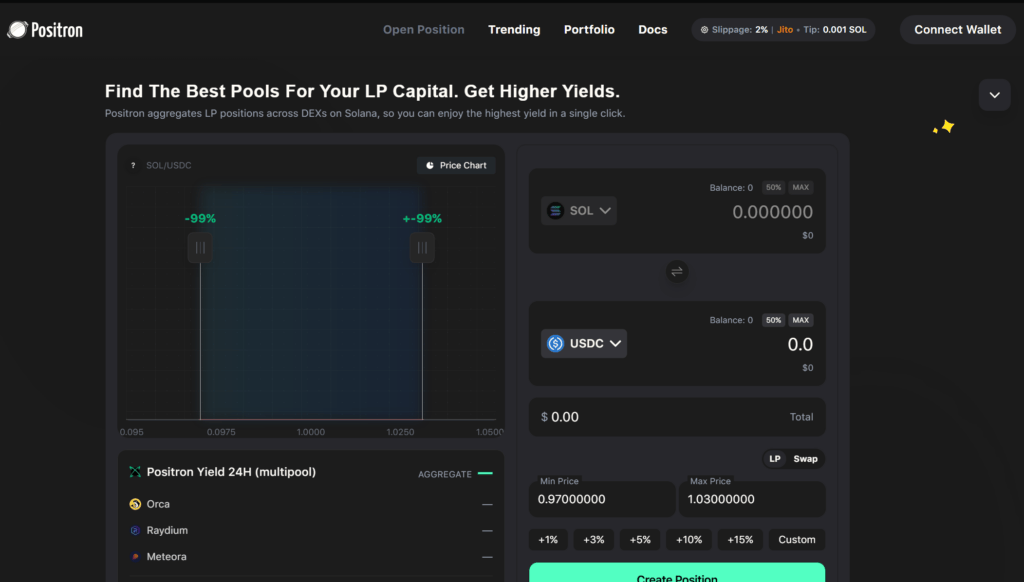

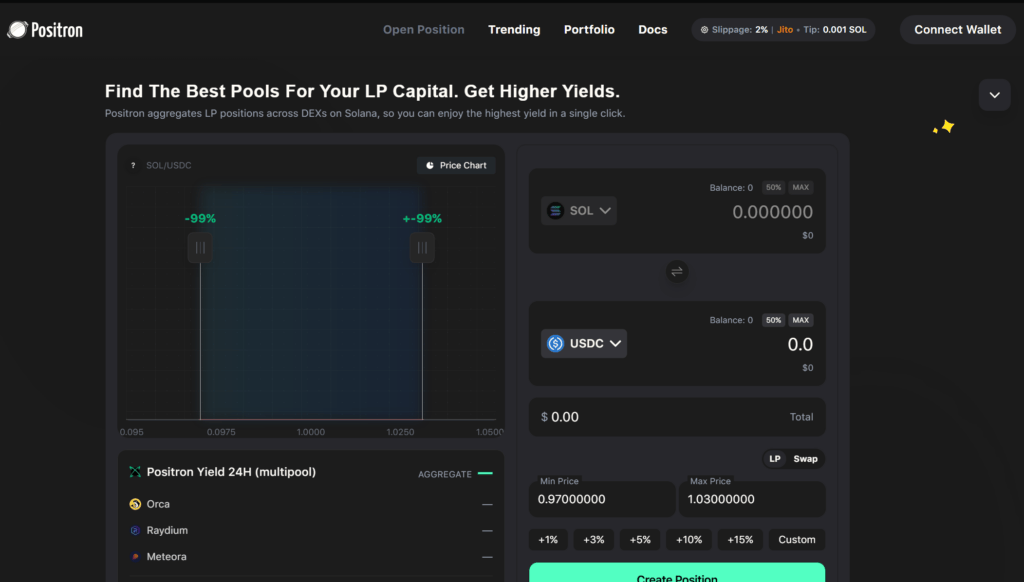

Positron is a DeFi aggregation platform designed to route trades across multiple decentralized exchanges and liquidity sources to find optimal execution for users. Instead of relying on a single DEX, Positron aggregates pricing and liquidity data from various protocols, allowing users to access deeper liquidity and potentially lower slippage through a single interface.

At its core, Positron functions as a smart routing layer. When a user initiates a swap, the platform evaluates available liquidity paths and determines the most efficient execution route, which may involve splitting trades across multiple pools or exchanges. This approach helps users avoid poor pricing that can occur when liquidity is thin or fragmented on individual platforms. By abstracting this complexity, Positron aims to make decentralized trading more efficient and accessible, especially for users operating across multiple chains and markets.

Also, you may read Top 10 PolyMarket Analytics Tools

TRY OUT POSITRON RIGHT NOW

Positron Aggregator Review: Getting StartedGetting started on Positron is straightforward. Liquidity provisioning works much like LPing on other DeFi platforms, with the added benefit of optimized routing and higher yield potential through aggregation.

Learn Liquidity Provisioning (LP)

New users can explore Positron’s onboarding guide to understand how LPing works, risks involved, and how returns are generated.

Open Your First LP Position

Once familiar, users can deploy liquidity directly through the Positron interface by selecting a pool and setting their position parameters.

Discover What’s Earning

The trending section highlights pools and positions currently generating strong yields, helping users identify opportunities across the platform.

Monitor Your Portfolio

All active positions, performance metrics, and yield data can be tracked in one place through the portfolio dashboard.

Also, you may read Top 10 Best Trading Podcast

TRY OUT POSITRON RIGHT NOW

Positron Aggregator Review: The Current State of LPing Why Single-Pool LPing Falls ShortTraditional concentrated-liquidity LPing requires committing capital to a single pool on a single venue, even though dozens or sometimes hundreds of pools may exist for the same trading pair. On Meteora DLMM alone, there are roughly 100 verified SOL–USDC pools, each with different characteristics and performance dynamics.

At first glance, it might seem logical to simply choose the pool advertising the highest APR or Fees/TVL. In practice, this approach is often misleading. Pools behave very differently depending on how they are structured and used by traders.

Several factors drive these differences. Tick spacing varies by pool and determines how tightly liquidity can be concentrated around price. Fee tiers differ widely, where higher fees may generate more per trade but reduce trading activity, while lower fees can attract volume but dilute returns. Trading volume is uneven across venues, with activity often shifting rapidly from one pool to another. Finally, liquidity distribution matters because LP fees are proportional to liquidity share, and dense liquidity in a pool can significantly reduce individual yield.

As a result, a pool showing a higher headline APR or Fees/TVL does not necessarily deliver the highest realized yield for a specific price range or liquidity size.

Also, you may read Hyperliquid vs Pacifica vs Reya vs EdgeX vs Orderly

Key Drawbacks of Single-Pool LPingFragmented liquidity: Capital competes in one pool while better fee density may exist elsewhere

Missed yield opportunities: When another pool outperforms, LPs must manually rebalance or lose potential returns

Inefficient capital usage: Static allocation ignores shifts in volume, fees, and liquidity concentration

Positron’s AdvantagePositron addresses these inefficiencies by routing liquidity across all supported pools automatically. Instead of forcing LPs to guess which pool will perform best, Positron dynamically allocates capital based on tick spacing, fee tiers, trading volume, and liquidity fragmentation. This adaptive routing ensures that liquidity is consistently deployed where it is most efficient, helping LPs capture stronger, more stable yields without constant manual intervention.

Also, you may read Best 10 Solana Telegram Trading Bots

TRY OUT POSITRON RIGHT NOW

Positron Aggregator Review: Positron’s Multi-Position Model

Liquidity and yield on Solana are highly fragmented across multiple decentralized exchanges and pool designs. For the same asset pair, market depth is often split across venues such as Orca, Raydium, and Meteora, each with its own liquidity distribution, tick spacing, and fee structure.

This fragmentation becomes clear when visualizing overlapping liquidity curves. Each pool concentrates liquidity at different price levels, creating multiple peaks in depth rather than a single, unified market. As a result, no single pool consistently offers the most efficient fee capture across all price ranges.

Without aggregation, LPs are forced to select one pool and hope it performs well. In reality, trading activity frequently shifts between venues, tick spacing influences how efficiently liquidity earns fees, and changes in liquidity distribution can dilute returns. What looks optimal at entry can quickly become suboptimal as conditions evolve.

Positron addresses this by treating all supported pools as a single liquidity landscape. Instead of locking capital into one venue, Positron dynamically deploys liquidity across multiple pools, allocating capital where it earns the most per unit of liquidity at any given time.

In practice, Positron splits liquidity into multiple sub-positions within a chosen price range. For example, in a SOL/USDC ±10% range, a 5 SOL position may be deployed across three sub-positions, while a larger 50 SOL position may be split into four sub-positions. This adaptive sizing allows larger positions to access more granular liquidity opportunities while keeping smaller positions efficiently concentrated.

The result is more efficient capital usage, reduced dependence on a single pool’s performance, and improved yield capture across a fragmented DeFi landscape.

Also, you may read Hyperliquid vs Rollx vs AsterDEX vs Avantis vs Paradex

TRY OUT POSITRON RIGHT NOW

Positron Aggregator Review: APR CalculationPositron estimates APR by translating a user’s budget and price band selection into projected fee earnings using recent, real pool data across supported venues. Rather than relying on headline APRs or Fees/TVL ratios, the model evaluates how liquidity would realistically perform within a given range.

At a high level, Positron converts your capital allocation into venue-specific liquidity positions, then estimates how much of recent trading fees your liquidity would have captured.

Also, you may read Bridgoro Review: The Ultimate Guide

How APR Is Estimated for Each Selected BandFor every price band selected, Positron follows these steps:

Start with your total budget and the allocation assigned to that band

Convert the allocation into venue-specific liquidity, respecting each pool’s tick spacing and mechanics

Pull the pool’s last 24-hour fees (USD) along with tick-level liquidity density for the selected range

Distribute the band’s fee mass evenly across all ticks in that range as a simple, conservative default

For each tick, estimate your share of total liquidity

Apply an aggressive cap on liquidity share to avoid unrealistic outcomes when a position would dominate the pool

Sum estimated fee share across all ticks to derive daily fees (USD) for the band

Once this is computed, the aggregate estimated fees are benchmarked against the top-performing pool from each protocol to provide context on relative performance.

Also, you may read Top 10 ways to Make Passive Income With Copy Trading Solana Wallets – EARN HERE NOW

Important Note on Model AssumptionsThe current APR model assumes uniform fee contribution across ticks, which is intentionally conservative. In practice, fee generation is often concentrated closer to active trading prices.

Positron is actively exploring refinements to this approach, including non-uniform fee density models and price-aware fee scaling. One potential improvement under consideration is modeling price movement and fee generation using a Brownian-style framework, which would better discount ticks far from top-of-book liquidity and produce more realistic APR estimates.

Also, you may read Hyperliquid vs AsterDEX vs Lighter vs edgeX vs Apex

TRY OUT POSITRON RIGHT NOW

ConclusionPositron tackles one of the most persistent inefficiencies in DeFi liquidity provisioning: fragmentation. In ecosystems like Solana, where dozens of pools compete for the same trading pairs, single-pool LPing often leads to suboptimal capital usage and missed yield opportunities. Positron’s multi-position and aggregation-first approach reframes this problem by treating all pools as one unified liquidity landscape.

By automatically routing liquidity across venues, splitting positions intelligently, and estimating APR using real, recent fee data, Positron reduces the guesswork traditionally required from LPs. Instead of chasing headline APRs or manually rebalancing positions, LPs can focus on defining their risk and price range while the protocol optimizes deployment under the hood. While APR estimates remain probabilistic rather than guarantees, Positron’s transparent and conservative methodology makes it a compelling tool for LPs seeking more efficient, data-driven yield capture in a fragmented DeFi environment.

Frequently Asked Questions

How is Positron different from traditional LPing?

Traditional LPing requires choosing one pool and fee tier. Positron automatically splits and routes liquidity across multiple pools, adapting to fee tiers, tick spacing, volume shifts, and liquidity density.

How does Positron calculate APR?

APR is estimated using last 24-hour pool fees, tick-level liquidity data, and a conservative assumption that fees are evenly distributed across ticks, with caps applied to avoid unrealistic dominance scenarios.

Which chains or ecosystems does Positron support?

Positron is currently focused on Solana-based liquidity venues, integrating pools across multiple Solana DEXs.